Slash Your Card Payment Fees Instantly!

Are you tired of ever increasing card payment machine fees?

We have discovered a fantastic card machine provider called Musqet and they have promised to save your businesses hundreds of pounds per year in fees. They could be without a doubt the best value card machine provider in the UK right now. charging fees from as little as 0.4% + 4p per transaction. Could save you up to £396 over two years on your current provider.

See the savings that you can make by changing your card provider to Musqet!

Assumptions:

- The salon processes £2,000 per month in card transactions.

- The average transaction size is £25 (80 transactions per month).

- Providers with fixed per-transaction fees (e.g., Dojo, Revolut, Musqet) are calculated accordingly.

- Using a average fee of 0.6% + 4p per transaction on Musqet as (fees are split for domestic debit cards 0.4% + 4p & 0.8% + 4p for domestic credit cards) based on salon payments via credit and debit card being 50/50

Annual Cost Comparison

| Provider | Transaction Fee | 6 Months (£) | 12 Months (£) | 2 Years (£) | Savings vs. Square/Zettle (12M/24M) (£) |

|---|---|---|---|---|---|

| Square/Zettle | 1.75% | £210 | £420 | £840 | Baseline (0 savings) |

| SumUp | 1.69% | £202.80 | £405.60 | £811.20 | £14.40 / £28.80 |

| Dojo | 1.4% + 5p | ~£188 | ~£376 | ~£752 | £44 / £88 |

| Revolut | 0.8% + 2p | ~£104 | ~£208 | ~£416 | £212 / £424 |

| myPOS | 1.10% + 7p | ~£143 | ~£286 | ~£572 | £134 / £268 |

| Barclaycard | 1.4% + rental | ~£168 + rental | ~£336 + rental | ~£672 + rental | £84+ / £168+ |

| Worldpay | 1.5% + rental | ~£180 + rental | ~£360 + rental | ~£720 + rental | £60+ / £120+ |

| ⭐ Musqet* (0.4% + 4p & 0.8% +4p) | 0.6% + 4p | ~£111 | ~£222 | ~£444 | £198 / £396 |

Key Insights

- Musqet at 0.4% + 4p for domestic debit card per transaction and 0.8% + 4p domestic credit card now costs £222 per year, significantly cheaper than Square/Zettle (saving £198 per year or £396 over two years).

- Dojo and myPOS could be more expensive, making Musqet a better mid-range choice.

- Traditional providers like Barclaycard and Worldpay remain the most expensive, especially when factoring in rental fees.

- a one time purchase of £250 does apply to buy the Musqet PDQ, but this becomes yours outright with no monthly rental fees.

Potential Savings Over Time.

If a salon switches from Square/Zettle to Musqet:

-

Saves £198 per year

-

Saves £396 over 2 years

-

That’s a WHOPPING 47% reduction in fees

For salons processing higher monthly volumes, the savings will be even greater.

Our Conclusion is: Switch to Musqet

✅ Lowest fees: Just 0.4% + 4p per transaction (on debit cards)

✅ Instant savings: Save up to £396 over two years.

✅ The only payment processor that has a bitcoin option.

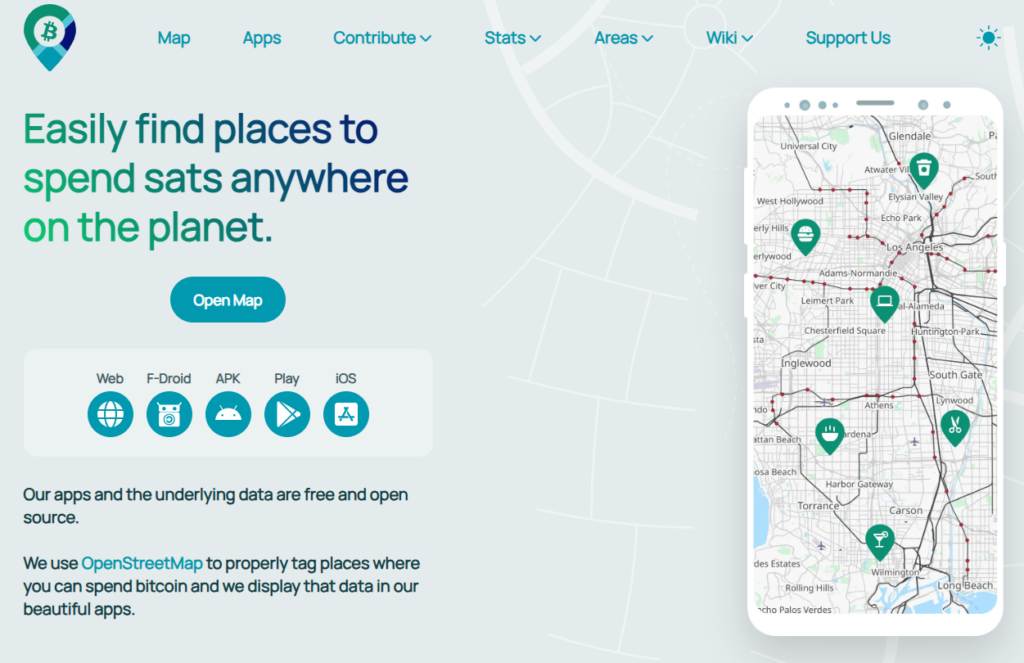

✅ The only option that enables free visibilty via btcmap.org

✅ More profit in your pocket – No hidden fees, no hassle

But that's not all!

✅ Accept Bitcoin and open your business up to new clients + free advertising on BTCMAP.org

But that’s not all! The Musqet machine also accepts Bitcoin payments, allowing your business to tap into a growing community of Bitcoin users.

Plus, when you accept Bitcoin, your salon gets free advertising on BTCMap.org, helping attract new, tech-savvy customers who prefer to pay with crypto.

Musqet also has an integrated ePOS system that could save you even more money on software and services that you do not even need. (I’ll let Mike tell you more about that one.)

Stop giving away your hard-earned money! Whether you run a salon, barbershop, or beauty clinic, switching to a lower-fee provider could mean an extra £400+ in your pocket over the next two years.

Act Now & Start Saving! Find out how easy it is to switch – It’s so easy to get started – contact Mike @ Musqet using the detail below.

MUSQET*

Tel: +44 (0) 330 111 6102

Web: https://musqet.tech

Email: [email protected]

Join the 14,000 businesses tapping into the £1.5 TN Bitcoin economy and let your customers put more £££'s in your bank through the magic of Musqet!

Disclaimer: The card machine fees and commission rates provided in this comparison are based on publicly available information from the respective providers’ websites at the time of research. These rates are subject to change at the discretion of the providers, and actual fees may vary depending on factors such as business type, transaction volume, and any negotiated rates. We recommend verifying the latest pricing directly with the payment providers before making a decision. GoSalon LTD is not responsible for any discrepancies or changes in fees after publication.

Making Retail Easy for you & your clients

- iPhone

- Android

- Bitcoin

- Windows

- Apple

- Linux

QUICK LISTENS (Salonomics)

Copyright © 2023 All rights reserved.