The Case Against VAT in Hair and Beauty

Okay, bear with me on this one. This blog post was inspired by a chat I had with main man Joe on the Salonomics podcast. The main chat was around inflation and VAT. Why our industry does not seem to understand how both of these things act as an annual pay cut for everyone working in the Hair & Beauty sector.

This article looks into these aspects:

-

- What is VAT and it’s historical context.

-

- Why is hair & beauty in the RETAIL bucket

VAT = Definition A value-added tax (VAT) is a consumption tax placed on a product whenever value is added at each stage of the supply chain, from production to the point of sale.

The amount of VAT that the user pays is on the cost of the product, less any of the costs of materials used in the product that have already been taxed.

WHY are we open to the idea of a consumption tax?

History = Germany and France were the first countries to implement VAT, doing so in the form of a general consumption tax during World War I.[5] The modern variation of VAT was first implemented by France in 1954 in Ivory Coast (Côte d’Ivoire) colony.

Recognizing the experiment as successful, the French introduced it in 1958. although German industrialist Wilhelm von Siemens proposed the concept in 1918. Initially directed at large businesses, it was extended over time to include all business sectors.

Of course, you could always look at the angle that New Taxes are to pay for old wars. War comes at a great cost to any economy that gets fooled into participating in it.

The amount of VAT is decided by the state as a percentage of the price of the goods or services provided. As its name suggests, value-added tax is designed to tax only the value added by a business on top of the services and goods it can purchase from the market.

“it can purchase from the market.” is seemingly the key part of the definition. Is a haircut a good that can be purchased from the market?

Goods that are imported from a VAT-free country into another country with VAT will result in no sales tax and only a fraction of the usual VAT.

https://www.gov.uk/guidance/rates-of-vat-on-different-goods-and-services

Tax is such a complicated issue and I understand why people just get on with it and pay it. I also understand those that work off the grid in order to avoid it. However with a national campaign forged by the elite salons and their PR companies. We may as well jump on the band wagon. And while we are here point out the ridiculousness of this TAX in our industry.

It seems to me that we get lumped in the retail bucket when it suits them. As far as I am aware there has never been a campaign raised by anyone to ask the question “Why is VAT added to a haircut?”

This VAT cannot be claimed back by Hairdressers/Barbers and Beauty Pro’s and you could even argue that Self Employed and Freelance hairdressers essentially pay this tax on behalf of the salons they work out of. I wrote a blog last year that looked into the practice of removing VAT before your commission was worked out. You can see that calculation here.

Let’s look at the Retail sector. Across the board there is a 20% VAT rate –

Hair and Beauty have been lumped into the RETAIL sector. Why? A time based service is not able to counteract inflation unlike every other entity within the retail sector.

There are zero benefits for hair and beauty to being in “Retail”

For example, I am a product company with the ability to mass produce hundreds of products on an hourly basis. I also have the ability to sell hundreds of products per hour. If the cost of the ingredients increase, I can replace them with cheaper versions or reduce the amount of product within a standard bottle to keep the price the same.

Technology improves and makes the manufacturing process cheaper and faster.

It is not possible to do our services any faster. So tell me, how are we considered in the same breath as a High St store that can sell hundreds of items per item via one shop assistant?

How did we get here?

I’ve discovered that one of the leading mouthpieces for hair and beauty in the UK. The National Hair & Beauty federation was partly responsible for exposing your hair and beauty business to the VAT man. The longest established hair & beauty federation in the UK. Failed to protect their members from the long arms and fingers of the TAX Man.

They relied on the support of the industry in terms of charging an annual subscription for their support and services. And yet when they had the opportunity to stand up and defend the industry they wilted and became advisers for the government on who to tax and where to tax.

In 1992 in an article on the Gov.uk website stated how the NHF advised the Government on the TAX implications. Without noting how it would create significant increase in costs and lost employment opportunities.

Now we see how this policy has lead to the disastrous decline of wages and standards in an industry that is so labour intensive and competitive.

In 2018 the NHBF supplied the government some solutions to update the VAT regulations within Hair & Beauty in the UK. Trying to rectify the damage that they enabled in the 90’s.

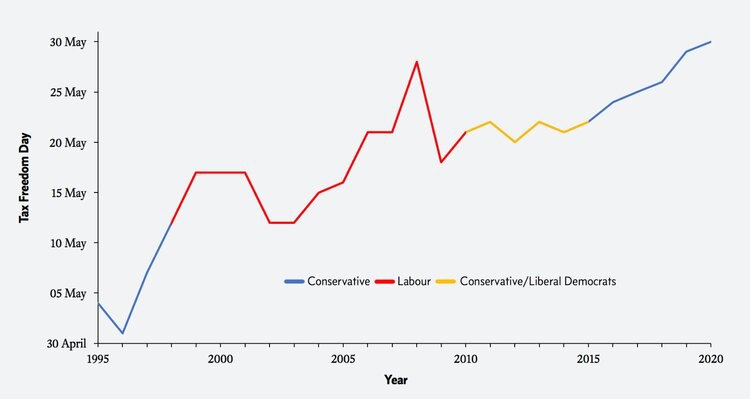

TAX FREEDOM DAY

When you put VAT into context of time. You work almost 6 months per year for the Government. This calculation includes everything from income tax, NI to VAT and other indirect taxes.

The chart above shows you how many months in a year “YOU WORK EXCLUSIVELY FOR THE GOVERNMENT!”

Let’s argue that we are selling our services based on Time and therefore we should be exempt like a financial advisor that sells financial products during an hour meeting is exempt or a Gym that sells access to its Gym equipment. Or a Massage Therapist (note the use of the term THERAPIST) is able to massage, free from the shackles of VAT.

If the Gym argument is “well it’s good for your mental health.”

Find me a hair or beauty service that doesn’t make you feel good afterwards?

Do we really have to change our title to Hairdressing Therapist? Do we have to lower ourselves to these childish games of cat & mouse between tax authorities.

How is it possible the TAX authorities can treat certain treatments and services one way and other labour intensive time based services another way? None of this makes any sense.

The solution is to campaign for the entire hair & beauty industry to be added to the Health & Wellness category.

Aaron Dorn

Health and Wellbeing as a sector is exempt from VAT.

How can we argue the point that we are in the wrong sector? This is the only valid course of action taken by us. Apart from civil disobedience of course. Then again, You can always go Self Employed and by default remove all of these headaches.

The other option is to shrink your business turnover so that you don’t have exposure to it in the first place.

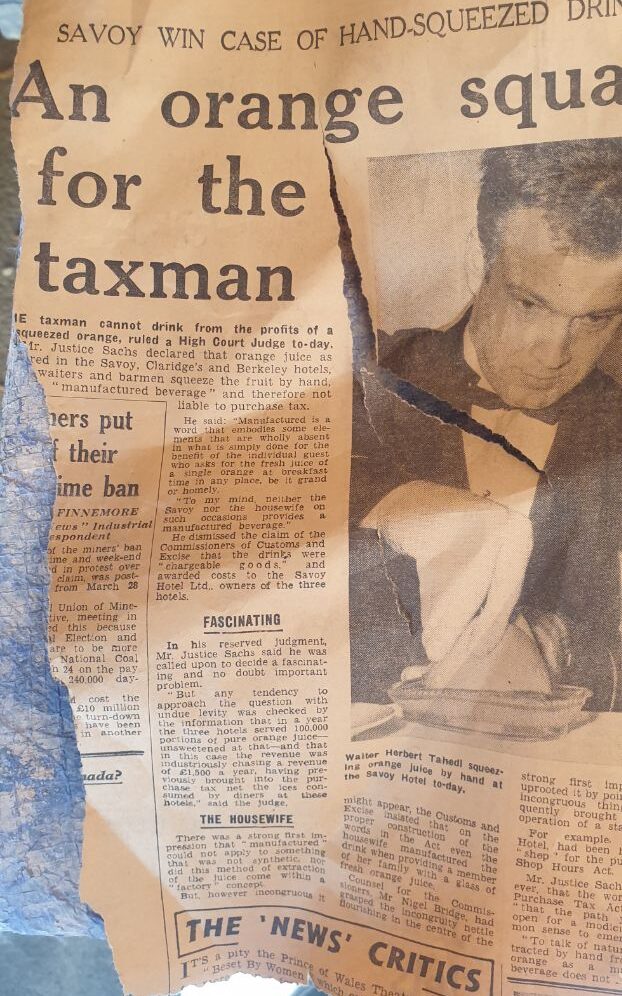

“The Savoy vs The Tax Man “Freshly Squeezed Orange Juice”

Has a David vs Goliath precedent been set. Yes and it’s a fascinating court case. I refer to a court case in 1966 between The Savoy Hotel versus Customs and Excise.

I discovered this story upon when doing some recent renovations. It was published in The Evening News in 1966.

The argument they took to court was “freshly squeezed orange juice should not be considered as manufactured” and therefore exempt from “purchase tax” They successfully argued to the judge that “manufactured” could not apply to something that was not synthetic, nor did this method of extraction of the juice come within a “factory” concept.

They won and the £1500 per year the revenue was chasing from this one hotel (£35000 in today’s money) HMRC were not to be deterred and it took them eight years (1974) in order to create more tax regulations that brought all beverages sold to be exposed to VAT.

Ironically, This decision did not apply to “Freshly Squeezed Orange Juice” until 1993. The Treasury at the time sneakily made a decision that went unscrutinised. The fresh juice industry at the time was worth over one billion pounds. Even though front bench politicians argued the new tax would cost up to 1850 jobs. The decision stood.

This proves direct and indirect taxes will increase forever unless we take a stand!”

Netherlands VAT reduction experiment 2000 – 2003

The goal was to create more FORMAL employment (or income tax payers, get workers that are off the grid, On the INCOME TAX grid.)

The noted outcomes were

-

- Salons passed the entire VAT cut to consumers in the form of lower prices.

-

- No statistical or economically significant effect on the employment in persons, employment in full-time equivalents (Which could be concluded as the experiment being only temporary, employers may not have wanted to go through all the fixed costs of employing new staff for something that was going to revert.)

-

- Volume of sales stayed similar. (Which they conclude is due to the strong competition in the sector and small sample size of businesses taking part in the experiment.)

-

- Employees on average worked more hours per week.

-

- The experiment was beneficial for the individual consumers business owners and employees.

-

- No reference was made to the amount of tax revenue received.

-

- Ultimately, More services were supplied and more hours of work was created.

-

- Therefore the industry as a whole was MORE PRODUCTIVE during the experiment as the VAT cuts were passed straight to the consumer.

resources – Netherlands experiment on cutting VAT from 17.5% to 6%

What is to come?

As we conclude, let’s remember that the inclusion of the hair and beauty industry in BEIS represents a significant step backwards. Our industry’s importance to the local community and the high street means it should be protected. However, there are some bad actors in our industry looking to sell us down the river.

The inclusion into another government QUANGO means they are actively looking at new ways to control and manipulate our industry into another Tax generating plan.

The added rules and regulation salons will be required to follow in order to comply will create further bureaucratic headaches for businesses already on the cusp.

There are factions within the hair & beauty industry who’s willingness to climb the political ladder means they are working against you, not for you.

In fact, It was the National Hair & Beauty Federation in 1992 that helped the Government figure out who they could apply VAT too. Yes, you read that correctly. The organisation that you support with an annual subscription fee, rather than go into bat for you and argue why this was an unreasonable tax. Actually green lighted it and threw you under a bus.

By joining forces, every element of this fantastic industry we could pool all of this collective might together. Could we fight HMRC in the courts? enable us to reverse this scandalous tax for EVERYONE. And encourage a brighter future for all, just like The Savoy did all those years ago.

“When Life Gives You Oranges, Squeeze them!”

The story of The Savoy Hotel’s battle against the Tax Man serves as a powerful reminder that united action can make a difference. If one private business can achieve such a victory, imagine the potential when entire industries come together to challenge excessive taxation and arbitrary regulations.

Let’s not wait until it’s too late. By pushing back against these regulations today, we can secure the future of our industries and protect the livelihoods of countless individuals.

The choice is ours. Will we let history repeat itself, or will we take a stand and shape a better future for all? Thank you, and let’s work together to ensure that by 2030, our industries not only survive but thrive. Goodnight!

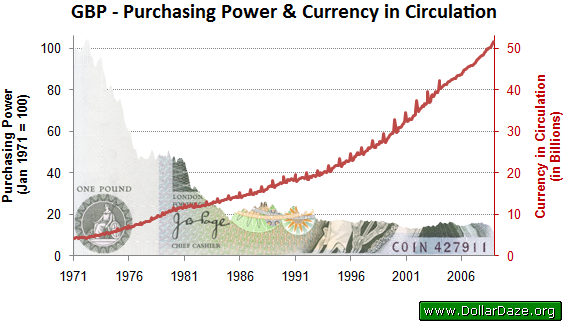

Inflation is another invisible tax

That we are exposed to unjustly in my opinion for all persons who work in a time related field – For example a company that mass produces a product can mitigate inflation by reducing the weight of a product and become more efficient producing it.

When you work in a time based service this is another TAX that we cannot free ourselves from. It’s no wonder the average wage for a hairdresser has gone down in terms of purchasing power. I wrote an important blog about this here.

It’s Time.

Stop burying your head in the sand. If you want to be able to work and trade either on the high street or in a super salon. Make a stand now otherwise these taxes will suffocate our industry to death. Stop begging the government to help us. They won’t. The opportunity is here now. You can adapt your business today or your business can be ignored in the next national crisis? It’s up to you.

P.S

Some of these issues can be countered by the simple act of using GoSalon.

GoSalon helps you generate a new revenue stream while at the same time cutting a lot of these expensive software costs that you ‘believe’ your business relies on. Stay tuned as I do not want to reveal everything now but the future for freelance & self employed hairdressers, Beauty Professionals and Barbers is bright.

Making Retail Easy for you & your clients

- iPhone

- Android

- Bitcoin

- Windows

- Apple

- Linux

QUICK LISTENS (Salonomics)

Copyright © 2024 All rights reserved.