This is the transcript of the 10 minute talk I was supposed to give at Salon International 2023. Until I got rugged by the How to Cut it Platform. And replaced as a speaker. I wonder why?

“When Life Gives You Oranges, Squeeze Them.”

Watcha, My name is Aaron.

Last month, I made a fascinating discovery that I want to share with you all today.

Chat gpt

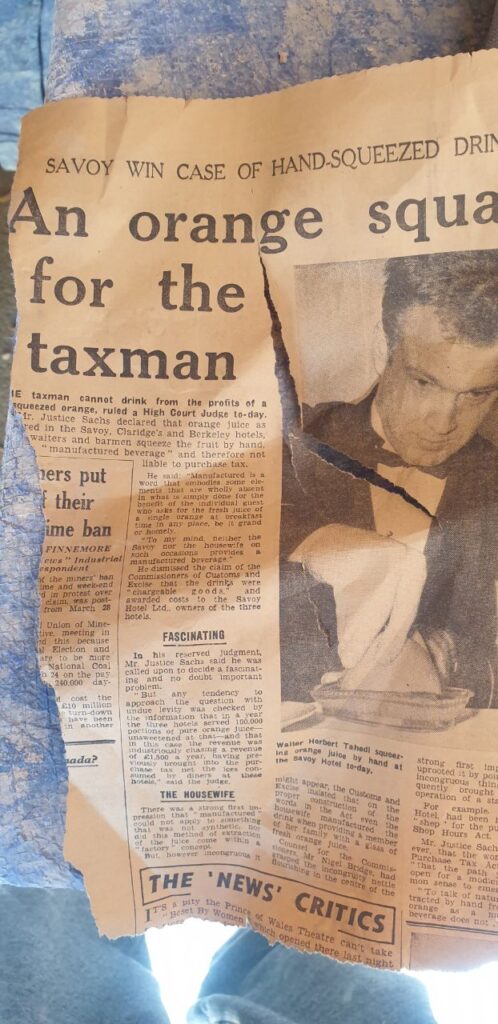

[Slide 2: Newspaper Headline] [Image: Image of a 1966 newspaper headline]

This discovery happened when I was doing a little bit of demolition in my home. I knocked down a wall and do you know what it revealed to me?

A newspaper article from 1966, published in The Evening News. This article chronicled the epic battle that unfolded in court. A real David v Goliath tale.

[Slide 1: The Savoy Hotel] [Image: Image of The Savoy Hotel]

Our story begins in the centre of London. The Savoy Hotel found itself embroiled in a legal dispute with the TAX MAN.

[Slide 3: The Legal Argument] [Image: Image of a courtroom]

The heart of the matter was a seemingly simple question: Should freshly squeezed orange juice be classified as “manufactured”? And, therefore, should it be exempt from purchase tax?

[Slide 4: The Savoy’s Argument] [Image: Image of freshly squeezed orange juice]

The Savoy Hotel argued passionately that “manufactured” could not possibly apply to something as natural as freshly squeezed orange juice. They contended that this method of juice extraction did not fit the concept of a “factory.”

[Slide 5: Victory in Court] [Image: Image of a gavel]

And, incredibly, they won! The judge ruled in favor of The Savoy, declaring that freshly squeezed orange juice was indeed not “manufactured.” This victory meant that The Savoy was no longer liable for the £1,500 per year in taxes that Customs and Excise had been pursuing. In today’s money, that’s equivalent to a whopping £35,000!

[Slide 6: HMRC’s Persistence] [Image: Image of HMRC logo]

However, the Tax Man, or HMRC, was not easily deterred. It took them eight long years, until 1974, to create more tax regulations. These regulations brought all beverages sold under the purview of Value Added Tax (VAT).

[Slide 7: Irony Strikes] [Image: Image of a glass of freshly squeezed orange juice]

Now, here’s the ironic twist. While this new VAT regulation applied to most beverages, it did not touch “Freshly Squeezed Orange Juice” until 1993. Why? Because the Treasury, in a somewhat sneaky manner, made this decision without much scrutiny.

[Slide 8: Industry Impact] [Image: Image of orange groves]

At the time, the fresh juice industry was a billion-pound behemoth, and the decision to tax it went unchallenged. Even though front bench politicians argued that the new tax would cost up to 1,850 jobs, the decision stood.

[Slide 9: A Call to Action] [Image: Image of protesters]

Ladies and gentlemen, this story underscores a crucial point. It shows us that direct and indirect taxes have a tendency to increase perpetually unless we take a stand. It serves as a reminder that even the most unlikely of heroes, in this case, The Savoy Hotel, can triumph over the Goliath that is the Tax Man.

[Closing Scene] [Spotlight back on presenter]

So, as we conclude our journey into the past, let us remember The Savoy’s brave battle against the Tax Man over a glass of freshly squeezed orange juice. It’s a story that teaches us that the smallest victories can sometimes have the most significant impact. Thank you for joining me on this historical adventure, and may you be inspired to stand up and question the ever-increasing taxes of our time. Goodnight!

[Slide 10: Point 1] [Image: Image of David and Goliath]

Point 1: If one private business can take on the TAX MAN, imagine what an entire industry can do?

We’ve seen how The Savoy Hotel stood up to the Tax Man and emerged victorious. But imagine the collective power of an entire industry united against arbitrary regulations and excessive taxation. This brings us to our next crucial point.

[Slide 11: Point 2] [Image: Image of a clock showing the year 2030]

Point 2: If we don’t take a stand now and push back on these arbitrary regulations, then by 2030, there will not be an industry to defend.

The clock is ticking, and the implications are clear. If we fail to take a stand and challenge these arbitrary regulations, the very industry we hold dear might cease to exist by 2030. The time to act is now.

[Closing Scene] [Spotlight back on presenter]

In conclusion, the story of The Savoy Hotel’s battle against the Tax Man serves as a powerful reminder that united action can make a difference. If one private business can achieve such a victory, imagine the potential when entire industries come together to challenge excessive taxation and arbitrary regulations.

Let’s not wait until it’s too late. By pushing back against these regulations today, we can secure the future of our industries and protect the livelihoods of countless individuals. The choice is ours. Will we let history repeat itself, or will we take a stand and shape a better future for all? Thank you, and let’s work together to ensure that by 2030, our industries not only survive but thrive. Goodnight!

Slideshow here